Excitement About Personal Loans Canada

Excitement About Personal Loans Canada

Blog Article

Some Ideas on Personal Loans Canada You Need To Know

Table of ContentsPersonal Loans Canada Fundamentals ExplainedPersonal Loans Canada Fundamentals ExplainedThe Definitive Guide to Personal Loans CanadaThe Basic Principles Of Personal Loans Canada The Personal Loans Canada DiariesThe 6-Second Trick For Personal Loans Canada

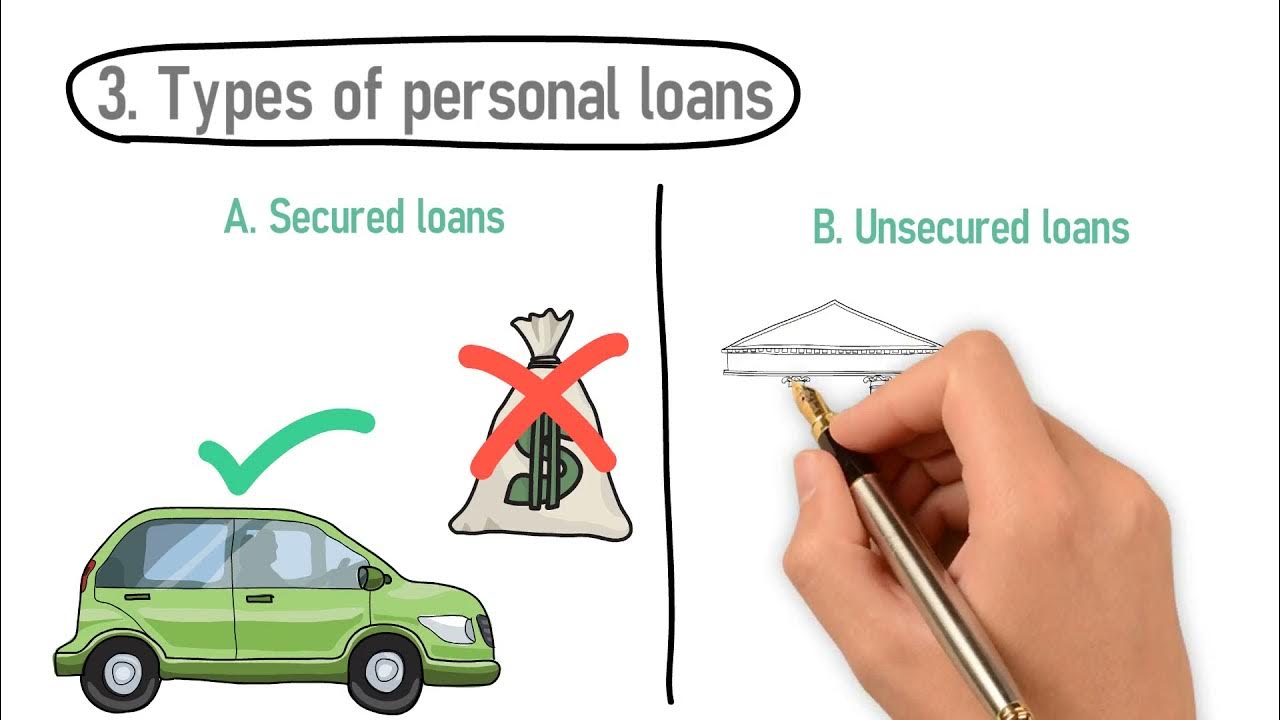

The rate of interest a loan provider offers you might vary relying on: your credit rating the kind of lender the kind of funding (protected or unprotected) You don't need to take financing insurance policy with a personal lending. Your lending institution may use optional creditor car loan insurance for your personal lending. With an individual loan, you agree to make routine repayments.Some lenders will send out details about your individual funding settlements to the credit score bureaus. Lenders might enable you to make additional payments to pay off your funding much faster.

This may assist you handle your budget if your financial situation modifications. There may be a cost for this solution. Prior to you take out a personal car loan, you need to consider your situation and your ability to pay it back. If you're having difficulty making your settlements, contact your lender. If you assume your checking account equilibrium won't cover your car loan payment, you may think about overdraft security.

Several individuals transform to personal financings in such situations. An individual funding is cash lent to you with passion.

The smart Trick of Personal Loans Canada That Nobody is Talking About

Lenders look at elements such as your credit score report, credit rating, and debt-to-income proportion to identify just how dangerous it is to offer you money. The rate of interest you pay is called an interest rate (APR). The APR is typically very closely linked to your credit rating. The better your debt, the better rates and terms readily available to you.

If you're authorized for a personal financing, you'll receive a round figure of cash, however you'll need to pay it back in regular monthly installations until the finance term expires. This is an important very first question to ask on your own, so take some time to assume concerning it. Remember, you'll owe passion for the duration of the funding, so you're always paying greater than the first amount you're borrowing.

Personal Loans Canada Fundamentals Explained

See to it you require the loan and that you are able to pay it back. On the flip side, if obtaining a personal financing to consolidate significant financial obligation can help you pay off that financial debt much faster, it may be a good option. Doing so can possibly conserve you cash by decreasing your rate of interest, along with make it a lot more manageable by reducing your overall month-to-month settlement amount.

That's because, specifically if you have good credit scores, individual fundings typically have better rate of interest than credit scores cards. If you're checking out a funding to cover clinical costs, talk to the health center initially to see if their invoicing department will collaborate with you on a settlement plan. At the end of the day, if you don't require to get a personal funding, after that don't.

There can be restrictions based upon your credit ratings or background. Make sure the lending institution supplies loans for at the very least as much cash as you require, and look to see if there's a minimum financing quantity. Nevertheless, understand that you may not get approved for as huge of a loan as you desire.

Variable-rate financings often tend to begin with a lower passion rate, but the rate (and your settlements) could increase discover this in the future. If you desire assurance, a fixed-rate lending may be best. Search for on the internet testimonials and contrasts of loan providers to learn regarding other borrowers' experiences and see which loan providers might be an excellent fit based upon your credit reliability.

The smart Trick of Personal Loans Canada That Nobody is Discussing

This can generally be done over the phone, or in-person, or online. Depending on the credit rating racking up design the lending institution uses, several tough inquiries that take place within a 14-day (in some cases up to a 45-day) home window may only count as one difficult questions for credit rating objectives (Personal Loans Canada). Additionally, the scoring design might overlook queries from the previous 30 days

Personal lendings aren't for everyone. If you require funds now, there are constantly other alternatives that may match your needs better. Each of them bill interest, however they're worth considering. Below are a few options to individual lendings, every one of which bring their very own threats and advantages depending on your situation.

Personal finances can be made complex, and finding one with an excellent APR that matches you and your budget plan takes time. Before taking out a personal loan, make certain that you will certainly have the capability to make the month-to-month payments on time. Individual financings are a fast way to obtain cash from a financial institution and other economic institutionsbut you have to pay the money back (plus rate of interest) over time.

All About Personal Loans Canada

There can be constraints web link based upon your credit report ratings or background. Make sure the lender provides loans for at the very least as much money as you require, and look to see if there's a minimum finance amount. Nonetheless, know that you could not get approved for as large of a financing as you want (Personal Loans Canada).

Variable-rate fundings have a tendency to begin with a reduced passion rate, yet the price (and your repayments) can climb in the future. If you desire assurance, a fixed-rate car loan may be best. Look for on-line reviews and comparisons of loan providers to learn more about various other consumers' experiences and see which loan providers could be a great fit based upon your creditworthiness.

This can generally be done over the phone, or in-person, or online. Relying on the credit history model the loan provider utilizes, numerous hard queries that occur within a 14-day (sometimes as much as a 45-day) home window might only count as one difficult questions for credit rating racking up purposes. Additionally, the scoring design may ignore queries from the previous 1 month.

Not known Incorrect Statements About Personal Loans Canada

If you get approved for a car loan, checked out the fine print. Check the APR and any type of various other costs and charges. You must have a complete understanding of the terms before agreeing to them. As soon as you accept a loan deal, numerous lending institutions can move the money straight to your bank account.

Personal loans can be made complex, and locating one with a great Homepage APR that matches you and your budget plan takes time. Before taking out an individual finance, make certain that you will certainly have the capacity to make the monthly payments on time. Individual car loans are a fast way to obtain cash from a financial institution and other financial institutionsbut you have to pay the money back (plus passion) over time.

Report this page